Make no bones about it, this whole stinkpile started with the regulation-free subprime market which allowed load sharks A.K.A. mortgage companies to swindle millions of hard working Americans out of their home. Minorities have fared worse than the rest, losing homes at a frightening rate. Back in 2007 we had a crucial opportunity to fix our housing market run wild, with the Mortgage Reform and Anti-Predatory Lending Act; Bill HR3915. How many families in Mississippi have faced foreclosure during this crisis? Our state is near the top per-capita in foreclosures.

How did Roger wicker vote on the Mortgage Reform and Anti-Predatory Lending Act; Bill HR3915?

HR3915 - Voted NO on regulating the subprime mortgage industry.

Thanks Roger Wicker for helping to facilitate the stinkpile.

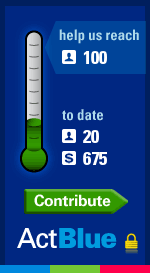

Donate now to Ronnie Musgrove to make sure we have a Senator who votes for the interest of his constituents. That is not asking too much is it Roger?

The subprime issue goes back years ago when civil rights groups complained about minorities not being able to get home loans. They said that all Americans are entitled to own a home. So, what happened? The pressure was put on and these companies gave them these loans they couldn’t pay back. They should of never approved one loan, but you don’t want to be that company that is discriminating. The problem comes from that single issue.

ReplyDeleteOver $1.8 million was given to Obama from these subprime industries. The top ten subprime issuers gave him a total of $400,000. The most any pres. candidate has ever received. I think he should give it back since three of the top five in the country have gone belly up. Earlier this year Obama wanted an investigation into these companies for so called targeting minorities, but he is fine taking their money in the end. People want to own a house, but don’t want to be responsible when they can’t pay the loan.

http://www.huffingtonpost.com/gerald-mcentee/obama-and-his-subprime-su_b_93778.html

Don’t be bamboozled Jeff.

The subprime issue is due to deregulation of financial markets. It is like playing football with no referees.

ReplyDeleteI don't care how much money hae has taken for them, his policy is the right way. McCain wants to further deregulate the financial markets which lead to further crisis.

Bill Clinton was saying on the stump this spring that 93% of all homeowners facing foreclosure had never missed a payment.

Bill Clinton was saying on the stump this spring that 93% of all homeowners facing foreclosure had never missed a payment.

ReplyDeleteWould you direct me to this speech? I'd like to see his source on this. I'm a little confused. If you have insight where he got that statistic, I'd like to see it.

Thanks, RPP

you can google it, bill clinton foreclosures not missed a payment

ReplyDeleteyou can google it, bill clinton foreclosures not missed a payment

ReplyDeleteThe statement Clinton made doesn't hold water. They didn't miss a payment - that is - until their payment ballooned under the terms of their DOT/Note/Mortgage.

ReplyDeleteSo yes, Clinton was technically correct. But he forgot to add that the borrower couldn't make payments on the note after the rate change.

Ok, I got it now.

For the record, I hold both the borrower and the lender responsible for this mess.